Top lithium supplier Albemarle Corp. delivered its most profitable quarter ever with prices of the battery ingredient extending gains even as recession fears undermine other metals.

The Charlotte, North Carolina-based firm reported third-quarter adjusted profit that beat the average analyst estimate and was more than seven times the same year-ago period. Albemarle tightened its annual adjusted profit forecast but raised the lower end of its guidance range for earnings before items, flagging “ongoing strength in lithium pricing.”

SIGN UP FOR THE BATTERY METALS DIGEST

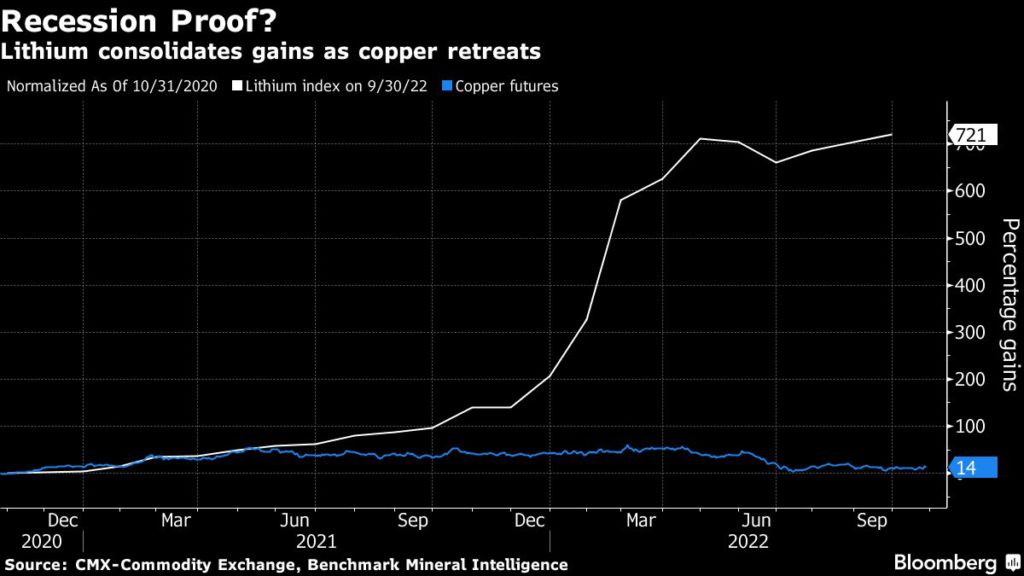

Albemarle is locking in sky-high prices in contract renewals, cushioning the blow of cost inflation. Suppliers are grappling to meet soaring demand for a key raw material in powering electric cars as other metals with a bigger presence in older industries, like copper, wilt under the weight of slowdown concerns.

Adjusted earnings came in at $7.50 a share versus the $6.95 average estimate and $1.05 a year ago. Net sales were slightly below consensus, with shares down slightly after the close of regular trading in New York.

Management is expected to offer insights into how long record-high prices can last in a 9 a.m. call with analysts on Thursday. Chief Executive Officer Kent Masters may also weigh in on industry deal buzz as miners look to move further down supply chains and car and battery makers seek to lock in scarce raw material supplies.

Albemarle is bringing on new facilities to process mined lithium into the chemicals needed for batteries, saying Wednesday that it’s on track to more than double conversion capacity from last year.

While Chile and Australia account for the majority of mined supply, China has more than half of all refining capacity. China’s processing and manufacturing dominance is coming into question amid trade and political tensions that are spurring a rethink of global supply lines. Still, it costs twice as much to build refining capacity in Australia and the US than in China.