The biggest banks are set for a bumper year in commodities, as the war in Ukraine whipsaws raw materials prices. That follows a sluggish decade during which many lenders scaled back or exited metals trading.

Bank of America Corp. and Morgan Stanley have hired for their metals divisions, while Deutsche Bank AG is weighing a return to the business it abandoned just under a decade ago.

Banks’ base metals earnings have climbed 25% to 30% this year, putting them on track for the best performance since the global financial crisis, according to Michael Turner, co-head of Coalition Greenwich. “Increased spreads, volatility and healthy flows have boosted bank revenues with a number looking to reinvest in the business,” he said.

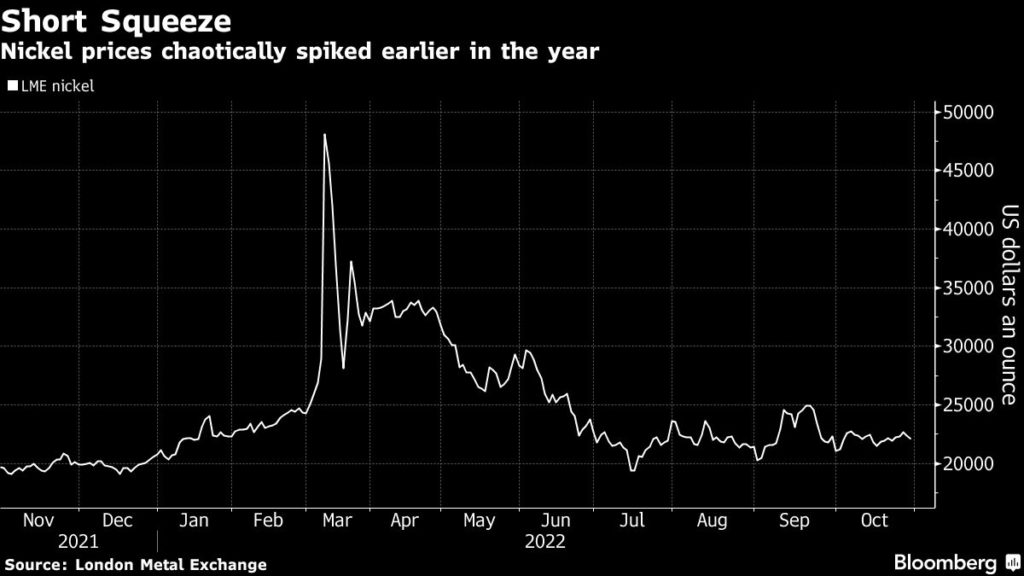

The hiring comes as JPMorgan Chase & Co., the longstanding market-leader, has been reviewing its exposure to commodities after March’s nickel short squeeze, in which it was the main counter-party of Tsingshan Holding Group Co., the world’s largest producer of the metal that was at the center of the crisis.

JPMorgan has in recent months cut back its financing to Chinese metals firms, Bloomberg has reported. Moreover, the reputation of the bank’s industry-leading precious metals division took a hit this year after its former managing director was found guilty of spoofing.

As JPMorgan pulls back in some areas, other banks are stepping up. Bank of America recently hired Ben Green, a base metals veteran, from Macquarie Group Ltd. The lender’s commodities division has typically focused on energy over metals like copper, aluminum and zinc.

Morgan Stanley has added to its precious metals desk, recruiting Patrick Hayes from Wells Fargo & Co. last month, according to people familiar with the matter. It also added Peter Smith, a physical business specialist who spent decades at JPMorgan. By contrast, Morgan Stanley recently lost Ryan McCartney, its base metals trading head, to hedge fund Squarepoint Capital.

Deutsche Bank has been exploring whether to hire someone to revive its base metals desk, according to people familiar with the matter and a job advertisement seen by Bloomberg. No decision has yet been taken, the people said, asking not to be named as the matter is private.

JPMorgan is the biggest bank by far in metals trading, with Goldman Sachs Group Inc., Citigroup Inc. and Macquarie also playing a big role. HSBC Holdings Plc is also a major player in the precious metals market.

Deutsche Bank, Bank of America and Morgan Stanley declined to comment.

(By Eddie Spence, Jack Farchy and Archie Hunter, with assistance from Yvonne Yue Li, Joe Deaux, Steven Arons and Sing Yee Ong